Trends in MEA Flexible Packaging Market 2025-35

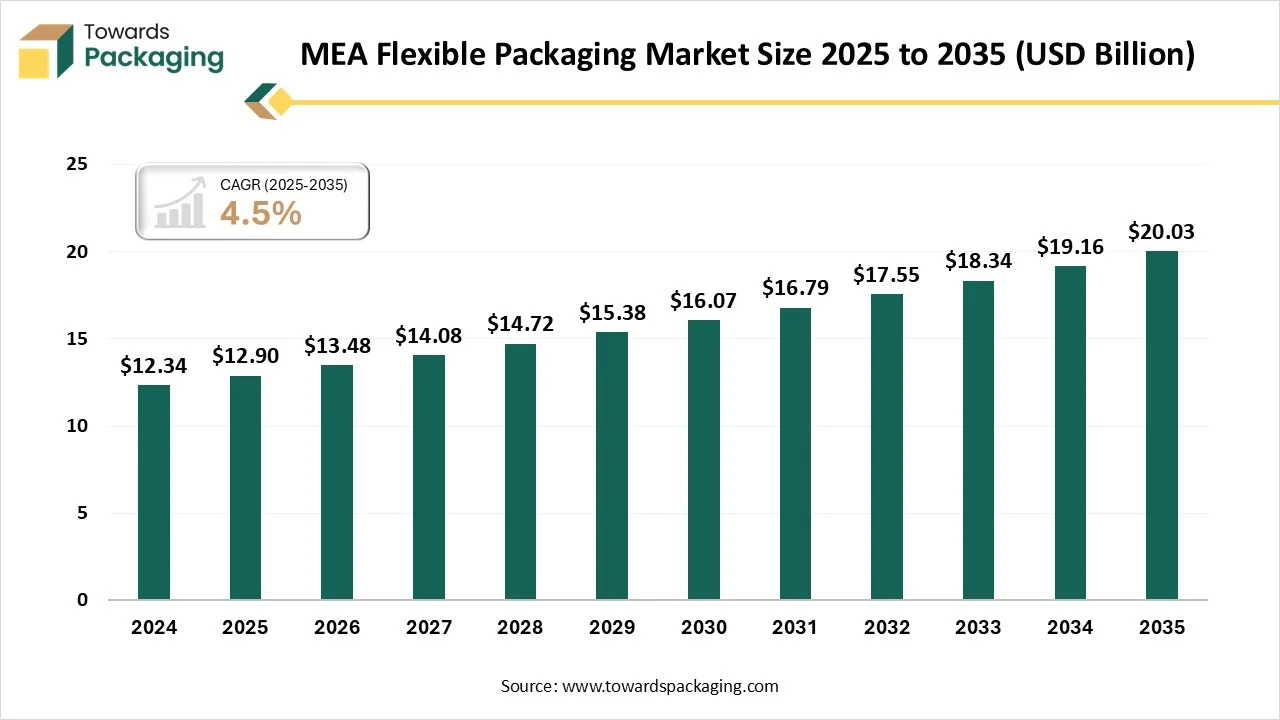

As highlighted by Towards Packaging research, the global Middle East & Africa flexible packaging market, valued at USD 12.90 billion in 2025, is expected to reach USD 20.03 billion by 2034, registering a CAGR of 4.5% throughout the forecast period.

Ottawa, Jan. 05, 2026 (GLOBE NEWSWIRE) -- The global MEA flexible packaging market reported a value of USD 12.90 billion in 2025, and according to estimates, it will reach USD 20.03 billion by 2034, as outlined in a study from Towards Packaging, a sister firm of Precedence Research. The Middle East & Africa flexible packaging market is driven by rising urbanization, growing demand for convenient food and beverage packaging, and expanding pharmaceutical and personal care industries.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

What is Meant by Flexible Packaging in MEA?

Flexible packaging refers to lightweight, bendable packaging materials such as films, pouches, and wraps that adapt to product shapes and reduce material usage. In the Middle East, the market is driven by population growth, rising packaged food consumption, retail expansion, cost efficiency, and increasing focus on sustainability. Sustainability initiatives, lightweight materials, and improved barrier properties are encouraging adoption across retail and industrial applications.

MEA Government Initiatives for the Flexible Packaging Industry:

- UAE Circular Economy Policy 2021–2031: This framework implements 22 circular policies, including mandatory Extended Producer Responsibility (EPR) and source-based waste separation, to shift the manufacturing sector toward recyclable and mono-material packaging.

- Saudi Arabia's "Made in Saudi" Program: An initiative under the National Industrial Development and Logistics Program (NIDLP) that provides financial and marketing incentives to local packaging firms to increase domestic production and boost non-oil exports.

- Kenya's Sustainable Waste Management Act: Effective May 2025, this law mandates that packaging producers and importers take full lifecycle responsibility for their products, including strict requirements for resin codes and recycled-content disclosure.

- Egypt’s National EPR Scheme for Plastic Bags: Enacted in March 2025 under Prime Minister's Decree No. 662, this initiative requires manufacturers to track production volumes and pay a fee per kilogram of plastic sold to fund waste collection and disposal.

-

East African Community (EAC) Packaging Standardization: In 2025, the EAC (including Kenya, Rwanda, and Tanzania) adopted unified standards for food-contact materials, such as paper-aluminum foil laminates, to harmonize compliance and safety requirements across member states.

Get All the Details in Our Solutions - Access Report Sample: https://www.towardspackaging.com/download-sample/5907

What Are the Latest Key Trends in the MEA Flexible Packaging Market?

1. Sustainability & Eco-Friendly Materials

Brands and regulators are pushing for recyclable, biodegradable, and mono-material packaging to reduce plastic waste and align with circular economy goals, driving the adoption of paper-based and bio-based films without compromising performance.

2. Advanced Barrier & Lightweight Solutions

Packaging innovations focus on enhanced barrier properties (moisture, oxygen, and light) and lightweight designs that extend shelf life, improve product protection, and reduce transport emissions, which are crucial for food, beverages, and pharmaceuticals.

3. Rapid E-Commerce Packaging Growth

Growth in online retail and e-grocery increases demand for protective, flexible, and easy-to-ship packaging formats, such as padded mailers and custom pouches, that reduce shipping costs and safeguard goods in transit.

4. Digital & Smart Packaging Technologies

Adoption of digital printing, QR codes, IoT sensors, and smart packaging enhances brand engagement, traceability, and consumer experience, while enabling short runs and customization for different markets.

5. Customization & Branding Focus

Flexible packaging offers high-quality graphics and tailored formats that help brands differentiate products on shelves, support premium positioning, and respond to evolving consumer preferences.

What is the Potential Growth Rate of the MEA Flexible Packaging Market?

Rising Consumption of Packaged Food & Beverage Consumption & Growth of Pharmaceutical and Healthcare Sectors

Rising packaged food and beverage consumption in the Middle East and Africa increases demand for flexible packaging due to its ability to extend shelf life, maintain product freshness, and support convenient, on-the-go consumption. At the same time, the growth of the pharmaceutical and healthcare sectors drives the need for high-barrier, tamper-evident, and contamination-resistant flexible packaging for medicines and medical products.

These industries benefit from flexible packaging’s lightweight nature, cost efficiency, and compliance with safety standards, encouraging wider adoption across the region.

More Insights of Towards Packaging:

- Consumer Packaging Market Insights, Forecast and Competitive Strategies

- Single Dose Packaging Market Intelligence Report, Key Trends, Innovations & Market Dynamics

- Biodegradable Plastic Films Market Strategic Growth, Innovation & Investment Trends

- Packaging Wax Market Size, Value Chain & Trade Analysis 2025-2034

- Chemical Packaging Material Market Insights, Forecast and Competitive Strategies

- Pre-press for Packaging Market Investment Opportunities & Competitive Benchmarking

- Horizontal Form-Fill-Seal (HFFS) Pouching Machines Market Size, Trends, Segments, Regional Insights, Competitive Landscape & Trade Analysis

- Pharmaceutical and Chemical Aluminum Bottles and Cans Market Size, Growth Trends, and Competitive Landscape Report 2025-2035

- Aseptic Packaging for Non-Carbonated Beverages Market Size, Share, Trends and Forecast 2024-2035

- Punnet Packaging Market Growth Drivers, Challenges and Opportunities

- End-of-Line Packaging Market Size, Share, Growth Analysis, Segments, Regional Outlook (NA, EU, APAC, LA, MEA), and Competitive Landscape 2024-2035

- Sealing and Strapping Packaging Tapes Market Size, Segments and Regional Data (NA/EU/APAC/LA/MEA) 2025-2034

- Isothermal Packaging Market Research Insight: Industry Insights, Trends and Forecast

- Hazardous Label Market Performance, Trends and Strategic Recommendations

-

Agricultural Films and Bonding Market Intelligence Report, Key Trends, Innovations & Market Dynamics

Regional Analysis:

The Middle East & Africa flexible packaging market shows varied regional dynamics, with Saudi Arabia leading due to rapid urbanization, rising disposable incomes, and strong demand for packaged food and beverages. Expansion of e-commerce and modern retail channels across the region increases demand for lightweight, durable, flexible packaging solutions.

Africa’s markets, like South Africa, Egypt, and Nigeria, are gaining traction through growing food processing industries, export-oriented packaging, and youthful populations, driving broader adoption of flexible formats and sustainable materials. Growing awareness of food safety, shelf-life needs, and technological advancements further support regional growth momentum.

The UAE Flexible Packaging Market Trends

In the UAE, the flexible packaging market benefits from strong consumer demand for convenience foods, ready-to-eat products, and growing e-commerce penetration. Investments in sustainable and recyclable packaging solutions are rising, with manufacturers innovating flexible formats across food, beverage, and personal care segments. The country’s role as a regional trade hub and focus on advanced packaging technologies reinforce its position as a significant flexible packaging market in the Middle East.

Segment Outlook

Material Type Insights

What made the Plastic Segment Dominant in the MEA Flexible Packaging Market in 2024?

The plastic segment dominates the Middle East and Africa market due to its low cost, high durability, and excellent barrier properties against moisture and oxygen. Plastics offer versatility in formats, lightweight benefits, ease of processing, and wide availability, making them suitable for food, beverages, pharmaceuticals, and personal care applications.

The multi-layer packaging segment is the fastest-growing in the market due to its superior barrier protection, extended shelf life, and enhanced product safety. It combines different materials to improve strength, moisture resistance, and durability, making it ideal for food, pharmaceuticals, and high-value consumer goods.

Product Type Insights

How the Pouches Dominated the MEA Flexible Packaging Market in 2024?

The pouches segment dominates the Middle East and Africa market due to its convenience, lightweight structure, and cost efficiency. Pouches offer excellent shelf appeal, easy storage, resealability, and strong barrier protection, making them widely preferred for packaged foods, beverages, personal care, and pharmaceutical products.

The sachets & sticks packaging segment is the fastest-growing in the Middle East and Africa market due to rising demand for affordable, single-use products. Their low cost, convenience, portion control, and suitability for food, beverages, pharmaceuticals, and personal care products support rapid adoption across emerging markets.

Film Type Insights

What made the Multi-Layer Films Segment Dominant in the MEA Flexible Packaging Market in 2024?

The multi-layer film segment dominates the Middle East and Africa market due to its superior barrier properties, durability, and ability to extend product shelf life. Combining multiple materials enhances protection against moisture, oxygen, and light, making it ideal for food, pharmaceutical, and personal care packaging applications.

The single-layer recyclable film segment is the fastest-growing in the market due to rising sustainability regulations and brand commitments toward recyclable packaging. These films simplify recycling, reduce material complexity, lower environmental impact, and meet consumer demand for eco-friendly packaging while maintaining acceptable barrier and performance characteristics.

Printing Technology Insights

How the Rotogravure Dominated the MEA Flexible Packaging Market in 2024?

The rotogravure printing segment dominates the market due to its ability to deliver high-quality, consistent prints at high production speeds. It is well-suited for long print runs, offers excellent color depth and clarity, and supports diverse substrates commonly used in flexible packaging applications.

The digital printing segment is the fastest-growing printing technology in the Middle East and Africa market due to increasing demand for customization, short production runs, and faster time to market. It enables cost-effective variable data printing, reduced setup time, minimal material waste, and supports brand differentiation and localized packaging needs.

Application Insights

Which Application Segment is Dominant in the MEA Flexible Packaging Market in 2024?

The food & beverage segment dominates the market due to high consumption of packaged and processed foods, growing urban populations, and demand for extended shelf life. Flexible packaging offers cost efficiency, convenience, portability, and strong barrier protection, supporting widespread adoption across food and beverage products.

The e-commerce packaging segment is the fastest-growing in the Middle East and Africa market due to the rapid growth of online retail, increasing smartphone penetration, and expanding logistics networks. Flexible packaging offers lightweight protection, cost-effective shipping, durability during transit, and customization options that support branding and efficient order fulfillment.

Distribution Channel Insights

What made the Direct Sales Segment Dominant in the MEA Flexible Packaging Market in 2024?

The direct sales segment dominates the market due to strong relationships between manufacturers and large brand owners. Direct sales enable bulk purchasing, customized packaging solutions, better pricing control, consistent quality assurance, and reliable supply for food, beverage, pharmaceutical, and personal care industries.

The online B2B platform segment is the fastest-growing distribution channel in the Middle East and Africa market due to increasing digital adoption, ease of comparing suppliers, and streamlined procurement processes. It offers manufacturers and buyers convenient access to a wide range of products, competitive pricing, and faster order fulfillment across regions.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

Recent Breakthroughs in the MEA Flexible Packaging Industry

- In November 2025, SIG, a packaging company, unveiled its Terra Alu-free + Full Barrier flexible packaging at Gulfood Manufacturing 2025 in Dubai. The material eliminates aluminum, reduces CO₂ emissions, and provides excellent barrier protection, extending shelf life. The launch won SIG the Best Packaging Innovation Award, emphasizing sustainability and efficiency in food and beverage packaging.

- In November 2025, Italian firm Industria Termoplastica Pavese (ITP) showcased its Triflex T-Lid and ClearSkinPack films at Gulfood Manufacturing 2025. These high-performance films offer superior barrier properties, transparency, and reduced thickness, catering to the region’s demand for efficient and eco-friendly food packaging solutions.

- In November 2025, Lamipak introduced an expanded sustainable packaging portfolio at Gulfood Manufacturing 2025, including LamiSleeve, Opticap 27, and Sensory Straw. The launch highlights functional, consumer-friendly designs and eco-conscious materials aimed at the food, beverage, and personal care sectors.

- In October 2025, UFlex launched its next-generation FlexiTubes at Beautyworld Middle East 2025 in Dubai. Featuring recyclable, biodegradable, and PCR-based materials, the tubes offer enhanced strength, 360° printing, and aesthetic appeal, targeting the beauty and personal care industries with sustainable and premium packaging solutions.

Top Companies in the MEA Flexible Packaging Market & Their Offerings:

- Amcor plc: Operates a dedicated MEA business unit providing high-performance, recyclable films and laminates for dairy, meat, and healthcare sectors.

- Sealed Air: Delivers advanced food-preservation technologies under the CRYOVAC® brand, including barrier shrink bags and vertical form-fill-seal films that extend shelf life.

- Berry Global: Specializes in versatile flexible plastic tubes and B Circular range pouches designed for easy recycling in homecare and beauty markets.

- Huhtamaki: Offers mono-material blueloop™ solutions and ultra-high barrier paper alternatives to plastic from its state-of-the-art manufacturing hubs in the UAE.

- Coveris: Provides a wide array of sustainable films and pre-made pouches specifically optimized for the fresh produce and pet food markets.

- Uflex Limited: Acts as a one-stop-shop for multi-layered laminates and high-barrier pouches used in snacks and pharmaceutical packaging.

- Clondalkin Group: Focuses on high-quality printed flexible packaging and lids for the dairy, confectionery, and tobacco industries.

- Sonoco: Supplies custom-engineered flexible films and stand-up pouches with advanced convenience features like resealable closures.

-

Winpak: Specializes in high-barrier modified atmosphere packaging (MAP) and lidding films designed for perishable food protection.

Segment Covered in the Report

By Material Type

- Plastic

- Polyethylene (PE)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Polyvinyl Chloride (PVC)

- Others

- Paper

- Aluminum Foil

- Multilayer Packaging

By Product Type

- Pouches

- Bags & Sacks

- Wraps & Films

- Sachets & Stick Packs

- Shrink Films

- Flexible Laminates

By Film Type

- Single-Layer Films

- Multi-Layer Films

By Printing Technology

- Rotogravure

- Flexography

- Digital Printing

- Offset Printing

By Application

- Food & Beverage

- Pharmaceuticals & Healthcare

- Personal Care & Cosmetics

- Household Products

- Industrial Chemicals

- Agriculture & Fertilizers

- E-Commerce Packaging

By Distribution Channel

- Direct Sales

- Converters & Distributors

- Online B2B Platforms

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5907

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram | Threads

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

-

Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire | Globbook | Substack | Bluesky | Justdial | Crunchbase | TrustPilot | Bizcommunity - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Towards Healthcare | Towards Auto | Towards Food and Beverages | Towards Chemical and Materials | Towards ICT | Towards Dental | Towards EV Solutions | Healthcare Webwire | Packaging Webwire | Automotive Webwire

Towards Packaging Releases Its Latest Insight - Check It Out:

- Sustainable Secondary Packaging Market Trends, Investment Opportunities & Competitive Benchmarking

- Heat Sealable Packaging Market Key Trends, Innovations & Market Dynamics

- Wrap-Around Cartoning Machines Market Research Insight: Industry Insights, Trends and Forecast

- Unbleached Kraft Paperboard Market Size, Share, Trends, Segmentation, Regional Insights, Competitive Analysis & Global Forecast 2025-2035

- Non-Recyclable Plastic Packaging Market Size, Trends, Segments, Regional Outlook, Competitive Landscape, Value Chain & Trade Analysis

- Single-Use Glass Packaging Market Size, Trends, Segments, Regional Outlook, Competitive Landscape & Value Chain Analysis

- Track and Trace Packaging Market Size, Share, Trends, Segments, Regional Outlook (NA, Europe, APAC, Latin America, MEA), Competitive Analysis, and Forecast 2025-2035

- Thermoformed Cellulose Packaging Market Size, Share, Trends, Segmentation, Value Chain & Trade Analysis, Manufacturers and Suppliers, 2025-2035

- Rigid Paper Packaging Market Size, Share, Trends, Segmentation, Regional Insights, Competitive Landscape, Value Chain & Trade Analysis

- Business-to-Business (B2B) Packaging Market Size, Share, Trends, Segmentation, Regional Outlook (NA, EU, APAC, LA, MEA) Value Chain & Trade Analysis

- Plain Packaging Market Size, Trends, Segments, Regional Insights, Competitive Landscape & Forecast Analysis

- Active and Intelligent Packaging Market Size (North America, Europe, Asia Pacific, Latin America, Middle East & Africa), Trade, Manufacturers & Suppliers, and Value Chain Analysis

- Bamboo Packaging Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Inflatable Packaging Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Biodegradable Paper and Plastic Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Organic Substrate Packaging Materials Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.